A community of 30,000 US Transcriptionist serving Medical Transcription Industry

Here is the encore posting of an awesome graph

Posted: Jun 30, 2011

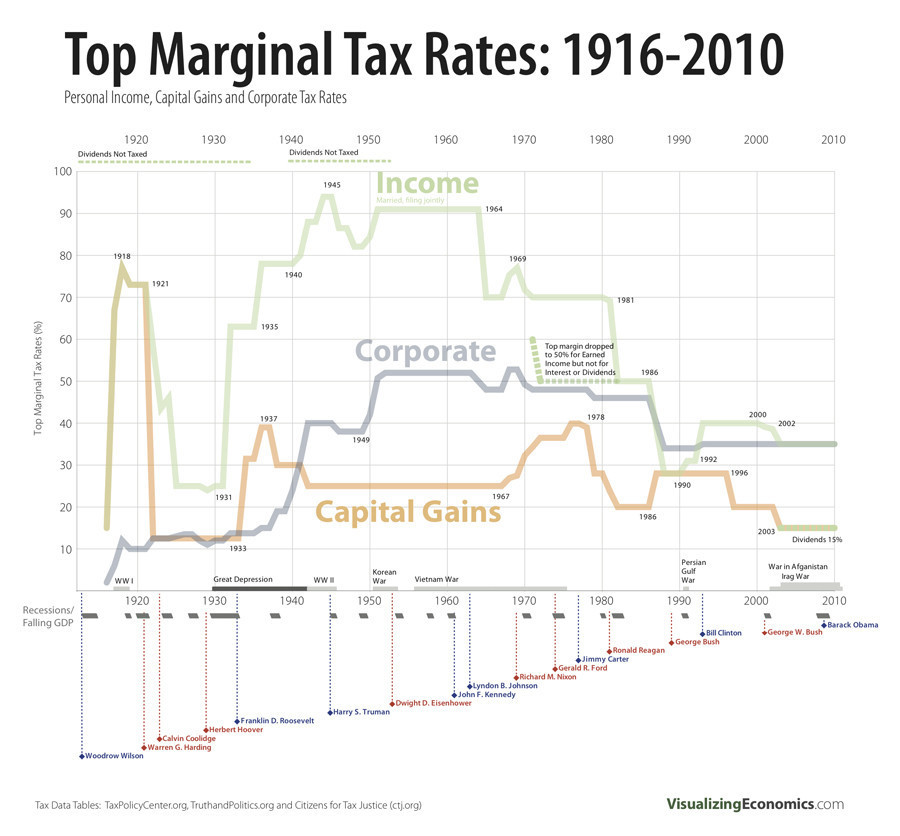

I was amazed it fit into the message box, but found out it would accommodate the size of graph by creating a slide bar at the bottom. It was originally posted in an earlier thread where tax rates before and after Ws tax cuts for the wealthy were being discussed. What I like about it is the historical data (wars, economic conditions, etc) that it incorporates and how it shows the presidents along with the years corresponding to the various tax rate fluctuations. It focuses on historical income, corporate and capital gains top bracket rates. Of note, if the tax cuts were to expire, they would be restored back to 200 rates, which still are the lowest rates (excluding the 1988-1992 five-year span ) since 1932. It is a little intimidating but really interesting, very informative and a lot of fun to play around with.

The 3 sources for the statistical data are shown on the last line of the graph.

http://visualizingeconomics.com/2011/04/14/top-marginal-tax-rates-1916-2010/

;Really interesting stuff - Thanks.

[ In Reply To ..]Now if we could only have a graph from a real source - not some gal and her brother

[ In Reply To ..]If you think their opinion is "awesome", well just don't know what to say.

Wish we could have a graph from a reliable source.

We know how you enjoy doing your own research - sm

[ In Reply To ..]and searching beyond the MSM, so I am sure you will enjoy verifying or refuting the information.

Doesn't matter who puts the graph together as long as the - stats are accurate.

[ In Reply To ..]I can play this game as long as you can. If you seriously question the data reflected from these 5 different sources and care anything at all about your own credibility, then POST YOUR OWN DATA THAT PROVES ME WRONG. Otherwise, continue to show your unwillingness to accept fact, which says much more about you than it ever could about the lady and her geographer brother who simply spread historically undeniable data across a graph grid. I already posted 5 separate sources that for one reason or another you have refused to look at, including a link to an easy-to-read straightforward table of years and top marginal tax rate numbers from the nonpartisan National Tax Union advocacy group. Like the others, they simply complied data from IRS records linked below. Yes, due to repeated recalcitrance, I am posting them again.

#1. This takes you to a chart which shows top bracket tax rates line by line from 1913 through 2008 with extensive footnotes. It is the most simplified version I could find. The National Tax Union is an independent, nonpartisan advocate for “overburdened tax payers”. These figures were used as a basis for the first graph I posted which by the way was not drawn by the same folks who drew the second one. The post was questioned because even though the sources are clearly indicated, the link I provided was to a blog where the NTU graph appeared. Thus, the slay-the-messenger attack was immediately mobilized in lieu of inspection, analysis and comment on the NTU information. Extraneous issues involving Obama were raised instead and in response, I directed the doubter to other posts where those issues had already been addressed and posed some questions. This of course was also ignored.

http://www.ntu.org/main/page.php?PageID=19

This prompted me to post the second, more detailed and more informative graph, that appeared on VisualizingEconomics.com., who clearly displayed the statistical sources for their graph data as shown below.

#2. This one takes you to a simplified table very similar to the one described above. Among the sources listed in this PDF doc, are Eugene Steuerle, The Urban Institute; Joseph Pechman, Federal Tax Policy; Joint Committee on Taxation, Summary of Conference Agreement on the Jobs and Growth Tax Relief Reconciliation Act of 2003, JCX-54-03, May 22, 2003; IRS Revised Tax Rate Schedules. Kindly note the year 2003, indicating the associated legislation that prompted the study which was elicited and accepted by the GOP-controlled Congress under W.

http://www.taxpolicycenter.org/taxfacts/Content/PDF/toprate_historical.pdf

#3. Another advocacy group for fair and sustainable tax structures

http://www.ctj.org/pdf/regcg.pdf

Or course the main source data used by these various references comes directly from the IRS. Perhaps you would like to take issue with agency records of their own historical tax records, keeping in mind that they have no need to be partisan one way or the other, since their sole purpose is to collect tax revenues regardless of who is in office calling the shots. Be my guest to argue with these figures and this source.

#4. Corporation Income Tax Brackets and Rates, 1909-2002. Lovely document with informative introduction and numbers, numbers and more numbers, all of which precisely correlate with graph and referenced data.

http://www.irs.gov/pub/irs-soi/02corate.pdf

#5. Personal Income Tax Rates of Bottom and Top Brackets 1913-2008

http://www.irs.gov/pub/irs-soi/histab23.xls

This is historical reality. Deal with it. We are so done here.

Read your message - sm

[ In Reply To ..]Okay, since you didn't insult me this time I read your message further. Funny thing isn't it...when you don't insult people they will read what you have to say. Insult them and the insult is the last thing they read.

So... here's the deal. Since you took it upon yourself to write all this out with what looks like your own opinions about it I read it all. And I researched the links you provided. The problem with the grafts themselves was when I researched who created them them there is no such company called VisualizingEconomics.com (at least that I could find after searching through 2 pages in Bing). What I did find was a little blurb that it is some unknown girl and her brother who like to make grafts. They could have made them for some school project for all I know. The question was where did they get their information. The grafts themselves were not clear on what exactly was the information they were trying to convey. I therefore researched the CTJ.org and at least found information about them and that was a very good site.

So there really was no need for your comment "I can play this game as long as you can". or "Deal with it". If you post something and the place is a reputable site that's one thing. Posting a graft that some unknown girl and her brother put together and when you go to research who this so called person is there is no information. All I'm saying is it looks fishy if you don't know where they get their figures from or who they are. Could have been the Olson twins for all I know. And, there really is no need to be nasty to people who just want to know that the information they are getting is reliable.

As for the information itself. Here's my take....

The richest of the rich were getting richer under Bush. They also happen to still be getting rich under Obama and they were getting rich under Clinton and before him. This goes way back further than just recently. If you hate Bush that's fine. I didn't vote for him and don't really care anything about him. All I know is nothing has changed since the new one came on board. That is because it's not their decisions. No president makes the decisions. Their bosses do and they just do what they are told to do.

Time to stop blaming Bush is over though. That is something you need to deal with.

Yes, I'm done here too.

Have a nice day.

The original graph had the NTU source - prominently displayed

[ In Reply To ..]directly under the title of the graph. This escaped you on account of your zeal to attack the blog where it appeared and while doing so, showing no interest in the data itself. According to your posts, you didn't just do this once, but again when I posted the second graph, all the while refusing to inspect the information.

This tactic is generally used by those who employ willful ignorance when faced with indisputable facts they find uncomfortable, something I find immensely insulting myself for a variety of reasons. Rather than resorting to stern parental finger-wagging lectures (laying down posting ground rules on which data one must post, what sources are acceptable and how one should express themselves), I prefer the innundation approach by providing the same numbers from the endless sources available at our fingertips, at least for those who are genuinely interested in getting at the truth.

Why did you go to Bing in search of a company when keying in visualizingeconomics.com brings up its site where lo and behold you find the About Us drop-down? Guess you were looking in the same places where you found the lady/geographer info instead of simply going to NTU.org, huh? I am sorry you have such a hard time reading cut-and-dry graphs where one can easily use the cursor/arrow/spike pointing thingy to trace the very straight line between the 2000 tax rate and that of 1932 (thus noting that all intervening tax rates are much, much higher), unless of course one is determined to resist the information at all costs.

I have already replied to your off-topic comments about Obama by directing you to other posts that addressed your insinuations about him (where I touched on the added factors of the GOP obstructionists) and asked questions which you continue to ignore. Until you feel inclined to elaborate on that silly comment about presidents not making decisions and the vague reference to his bosses who do, I will happily refrain from comment, especially since your post says a whole lot about nothing and nothing about tax policy.

This is not about blaming Bush, even though his tax cuts and other disastrous policies undoubtedly DID vaporize the surplus he inherited and contribute to the huge deficit he left behind. The tax cut argument is aimed at the brain-dead in Congress who continue to serve the interests of big business, wall street and the greediest among us. Their incessant whining about tax cuts expiration, their continued refusal to consider the revenue side of the budget equation and preposterous notions such as introducing a Constitutional crisis into the mix, all the while ignoring the urgency over jobs and unemployment, are what is happening in realtime, so please spare us the stop blaming Bush mantra. The obstructionism and these latest stunts give rise to well-founded speculation about delibrate efforts on their part to sabotage the economy for perceived political gain. This is something we ALL should be taking very, very seriously.

We may be done sparring about graphs, sources, lectures and the like, but I am not inclined to ignore the destructive forces that dominate the pathetic political dramas being played out within those chambers and will be taking every opportunity that presents itself to focus on the GOP spectacle.

See...there we go again - see message

[ In Reply To ..]I guess that need to insult just never goes away with some people.

The graph still sucks no matter how much you think its "awesome". There is no point of reference to understand what the heck it's saying. My 2nd grader could do a better job. And still, when you go to the website where they supposedly got their info from it still doesn't explain how they came up with that. The CTJ website itself is a good website with a graph that people can understand and know where the figures come from. Not the one some girl and her brother made.

Oh yeah, here's a news flash for you. Have you ever heard of the word assume. You did not reply to any of my "off topic comments about Obama" because I NEVER MADE ANY!!! and I have no idea what post you are talking about. You do realize that I am not the only one who posts messages on this board don't you?

And um, yes this is about blaming Bush. That's what it's always been about. Not putting ANY responsibility on the current administration. Hear that, "administration". I do not blame Obama for anything because he doesn't have control. Neither did Bush. And if you want to talk about that faux "surplus" you think he inherited that is for another topic.

Things may have been bad when the democrats took over after Bush left, but they are now worse and guess what it is their fault. Since the democrats won't work with the republicans to make things better and it's only blame Bush. No solutions...nothing. So I say please spare me with teh "it's not about blaming Bush" mantra because it is and you know it is.

I still say, how about a better graft. Better yet, just the facts from oh say, the white house website or other govermment websites. Not some girl and her brother. Sorry, I just prefer getting facts directly from official sources.

I too am not inclined to ignore the destructive forces. These past 3 years since Bush left office they have escalated three fold. If you understand economic then you understand that (and no it's not Bush's fault).

Here's a helpful hint. Your post might have done better if it wasn't riddled with insults. I didn't insult you. I stuck to the topic at hand, but you felt the need to insult me personally. How many people do you think will want to have a conversation with you if you have that need to insult them all the times. Just something I was taught growing up.

Still unwilling to discuss GOP congressional refusal - to address revenues

[ In Reply To ..]and instead lecturing, giving unsolicited advice and trying to tell me what I mean and don't mean. What a shock.

The graphs were posted to illustrate the GOP's hollow arguments in realtime and how disingenuous their whining over the possibility of allowing Ws tax cuts to expire really are. We get it. You don't do graphs and are not willing to confront this issue. No problem.

The graphs speak for themselves as does the behavior of the tiresome and predictble obstrutionists, whose strategy to fiddle while Rome burns to score political points is all too familiar and transparent. It is a tactic they have used before that ended up backfiring on them bigtime. I am prepared to sit back and watch that happen, though I think it is a real shame they are so blinded by greed and ambition that they would actually flirt with default, government insolvency and its costly, disastrous aftermath. Out of touch with reality. No surprise there either.

Similar Messages:

A Really Neat Graph For You To Look AtMar 21, 2011

It's an approval poll that compares all the presidents from Truman through Obama. You can move your pointer across at the bottom to find out what happened for the highs and lows. For instance, the Bay of Pigs is highlighted, as is Viet Nam. If you move your pointer up or down on the graph, it will give you the total percentage and you don't have to try to figure it out by yourself. http://www.usatoday.com/news/washington/presidential-approval-tracker.htm ...

I Love A Pretty GraphFeb 24, 2011

http://www.stateofworkingamerica.org/pages/interactive#/?start=1989&end=2008 The state of the American Worker. ...

Something AwesomeFeb 21, 2015

http://new.livestream.com/berrynest1/cam there are baby eagles being born and this is a link for a live stream. one baby is born, another egg is waiting to crack open. i've been riveted for days. don't let it mess up your work production, but its really really cool. there is a link at the top of the page that says "more event details" and there is another camera you can watch from also. just to cheer you all up. happy weekend and V-day. ...

I Had An AWESOME Weekend!Sep 26, 2011

I do hand-stamped jewelry and did a show this past weekend and it was my highest sales ever!!! My intake equaled three weeks of transcribing work. I wish I was brave enough to give up MT work and do jewelry only; but between December and May there are very few shows in my area. ...

Awesome SlippersFeb 04, 2010

I was "blessed" with wonderfully sweaty feet. I wonder if I'm the only one whose feet can be ice cold and sweaty at the same time. Well, for Christmas, my MIL got me these Isotoner slippers that are kinda like short boots. They let my feet breathe. I raved so much about them, my SIL got me a different style of Isotoner slippers for my birthday last month (I turned 29. Again. Aw, who am I kidding, I should now be saying I turned 39, and that has happened five t ...

For All You Awesome Dreamers Out There...Jul 27, 2013

Why own when you can rent! Save on property taxes at least, lol... Thought some of you might enjoy this. http://www.homesessive.com/view/castles-villas-yachts-and-islands-you-can-rent?icid=maing-grid7|main5|dl30|sec3_lnk2%26pLid%3D349058 ...

Castor Oil Is An Awesome MoisturizerMay 02, 2014

I can't believe how the fine smile lines on my cheeks disappeared after one application of this amazing product. I put some on my feet as well under my socks to soften calloused heels and rough soles. Nivea, Pond's, Noxema, who? It also has other properties that help your insides as well and no ingredients that shouldn't be put on your skin in the first place. Get the good stuff: Organic, cold-pressed, Hexane-free. I got mine at Vitacost on line along with my ...

Saw This In A Report Today And Thought It Was Awesome SmSep 07, 2010

The patient was excessively well-nourished. HAH! my new personal credo :) ...

How Awesome Is This!! Kinda Renews My Faith In People ... For Now, Lol Mar 31, 2010

http://newsmax.com/InsideCover/oreilly-marine-funeral-protesters/2010/03/30/id/354287?s=al&promo_code=9AAC-1 ...

"Who Killed American Unions?" Powerful Graph Shows Shows Middle Class IncomeJan 17, 2013

From The Atlantic: "Wisconsin Governor Scott Walker doesn't like unions, and unions don't like him. But the most remarkable thing about Walker's relationship to labor isn't that he thinks unions are worthless -- most Republicans agree -- but that he thinks about them, at all. Today, unions have been swept into dusty corners of the U.S. workforce, such as Las Vegas casino cleaners and New York City hotel staff. For much of the 20th century, things were different. A ...

About PostingMay 02, 2013

I have just deleted an entire thread that was only about posting guidelines and copying and pasting links, laws, and being sued. It had nothing whatsoever to do with politics and has been removed. If anyone wants to copy and paste articles or parts of articles please be so kind as to provide a link to show where you are getting your information and so it will not infringe upon the copyright laws. If anyone objects and has good reason, I am open to all discussions on it. I think the thre ...

Posting This Again - MO DanceFeb 25, 2013

This is a great video. It's worth another go. http://www.youtube.com/watch?v=Hq-URl9F17Y ...

I Found This PostingSep 05, 2013

I found this posting elsewhere and I wonder why nobody has had the courage to state this before, anywhere. I am posting it here to hopefully give some insightful thought into recent occurrences concerning Syria and the United States: "It's weird how Obama wants to avenge the deaths of a bunch of Muslims in Syria, but not the deaths of OUR people in Benghazi." This kind of puts perspective on where exactly the loyalties of this current "president" lies... certainly not with the peo ...

Deleting Repeat PostingMay 17, 2011

. ...

I Can't Believe I'm Posting A Link To This Site...Feb 12, 2013

(so fair warning that if you click on the link, you'll be giving a hit to Hot Air), but I was surfing along from a previous URL posted here and actually found the reporting interesting, in my contrarian interpretation of it, especially about California's implementation of the ACA, and thought it might be enlightening to get other medical health professionals here take on it. Me, personally, I love PAs and FNPs for my own care. They spend more time, are usually more holist ...

Fellow Liberals, Don't Bother Posting Nov 15, 2016

If you are not in total agreement with the lies and hatred on this board, no matter how benign, they will waaaah about it and have it removed. Leave them to wallow in their short-lived glory. Minor things for the left posted here yesterday are gone today, not even "flaming." But I see lots of "conservative??" flaming going on, apparently that is ok. Bye bye! ...

Insurance Companies Posting Record ProfitMay 14, 2011

Insurance companies and oil companies hoping repub zombie followers dont wise up anytime soon. ...

People Posting Irregularities They've Noted Personally. Nov 06, 2012

Gawker.com asks people to report. It's Election Day in America! What could possibly go wrong? Well, so many things. This already, from a reader in Pennsylvania: Poll workers ARE asking for your ID in PA. The lady that asked me for it said 'well I'd really like to see it'. She also needed three run throughs on her sheet to even find me. She did this for everyone ahead of me, and couldn't find 4 of them (i was #8 at my spot). Then they said my signature wa ...

Posting Guidelines - Bringing Back To BoardMay 06, 2013

I am bringing a topic back to the board, which I previously had deleted. I was wrong in deleting this message and my apologies to the OP of the post. This does indeed have everything to do with politics and I'd like to thank you for bringing that to my attention. I do make mistakes, and this is one that I should have left as is, so I will copy here what the message had originally said. If I've missed anything and you would like to add to it please do so. Your o ...

Posting About Public Citizen, Their Latest EmailNov 16, 2013

Can you handle some good news? Because as part of Public Citizen, you just had a good week. Let me back up a step. In the emails I send you, I often mention that this organization gets a lot of work done. But sometimes even I am struck by the sheer scope and impact of what the several hundred thousand of us who make up this collective project called Public Citizen accomplish together. Take a few minutes to at least skim this update. I think it will make ...

I'm Pretty Sure My Message Got Lost So I'm Posting It Here On The Violence Against DemsMar 25, 2010

My search on violence against republicans had duplicate articles, but the 2 that pop up most often in mine is the Huffington Post who told Obama to "break the kneecaps of the pubs" , Roland Martin of CNN who told O to go "gansta against the pubs", among others. Just for your info, the dems chose violence against the 'pubs ever since the [pub] party began back in the 1860s-18702. Are we pushing the Eric Cantor one under the rug, too? Here is one you ...

Left-wing Activists Posting Ted Cruz's Home Oct 18, 2013

address and family info online and encouraging harassment. ...

DEMS BALK AT POSTING HEALTHCARE BILL/LEGISLATION ONLINEOct 21, 2009

http://www.newsmax.com/headlines/pelosi_healthcare_online/2009/10/20/274652.html ...

ALL POSTERS: Please Read General Posting Guidelines Listed Above. NMDec 06, 2009

. ...

Yesterday's "test" Posting About Not Being Able To Post Still Holds TrueSep 26, 2012

I can answer posts but not post new messages. I did a virus check, malware, registry, disk defrag, etc. you name it. I did it. This morning, same thing. "You have been permanently banned from posting on this site." So I did a Restore back 5 days. Still got the same message. Up until yesterday afternoon, I had no problem. So, if THIS message posts, all I can say is bye-bye since I won't be able to contribute any new posts and do not want to just answer posts. It's been fun sparring w ...

Alabama Teen Beaten In Critical Condition After Posting "blue Lives Matter"Oct 04, 2016

is in critical condition after being assaulted this weekend. According to Sylacauga Police Chief Kelley Johnson, Brian Ogle was assaulted in an Ace Hardware parking lot following Sylacauga High School’s homecoming game on Friday. When authorities arrived on the scene, they discovered Ogle beaten and bleeding from the head. He was airlifted to the University of Alabama Birmingham Hospital where tests revealed three skull fractures and trauma to his shoulder. Ogle remains in crit ...