A community of 30,000 US Transcriptionist serving Medical Transcription Industry

The Wisdom of Stephen Colbert

Posted: Jun 29, 2011

"If this is going to be a Christian nation that doesn’t help the poor, either we’ve got to pretend that Jesus was just as selfish as we are, or we’ve got to acknowledge that He commanded us to love the poor and serve the needy without condition, and then admit that we just don’t want to do it."--Stephen Colbert

;Half-witted idea - anon

[ In Reply To ..]The problem with this, is it assumes the only way a Christian can help the poor is have the government tax them, and then have that same government distribute that as they see fit. Of course, any intelligent person would realize how foolish Mr. Colbert's remark is. Many Christians help the poor by contributing to charitable organizations or to their church, e.g., Chatholic Charities USA and a multitude of other Catholic charities, not to mention all the other denominations.

Not to mention - anon

[ In Reply To ..]You can hardly argue that there should be separation of church and state and then complain that the state does not follow the principles of the church.

Therefore, since there is separation of church and state, Christians (and people of any or no religion) should help others, if based on religious principles, apart from the state, not through the state. In other words, through private charity not governmental charity.

On the other hand, - it makes no sense to

[ In Reply To ..]invoke the Bible when arguing allegedly secular policies relative to preservation of marriage and reproductive rights, attempting to impose exceedingly narrowly defined family values via political process and/or legislating morality at every turn (while ignoring unemployment, jobs, the economy, etc.) then turn a deaf ear and a blind eye to the previously posted Biblical perspectives on money and wealth.

Sorry. You can't have it both ways.

Kinda like those rich people democrats hate - sm

[ In Reply To ..]even though part of our unemployement, lack of jobs, and economy are the faults of many RICH democrats. Funny how some of you want it both ways when it comes to blaming the rich and yet you place no blame on the rich democrats. Not to mention that it has been proven over and over again that republicans donate more money to charity than democrats do.

My biggest problem with giving money to the government to distribute as it sees fit is that more often than not those rich politicians in Washington don't use that money wisely. If they did, we wouldn't be spending more than we are bringing in. Not to mention that people who know the government will take care of them become dependent. Take a good look at Greece. The people there have become so dependent on government providing that when the government has to cut back, the people riot. That is our future if we don't stop this nanny state crap.

Some of you also talk about the rich and how they take advantage of loopholes in the tax code. Those evil rich jerks that everyone wants to see pay more money and yet I haven't seen politicians on either side do much about closing those loopholes that everyone uses when they can.

Like you said...you can't have it both ways. Yes, Jesus would want us to take care of others and he even paid taxes unto Caesar, but I find it hard to believe that he would prefer us give our money to the government to distribute for us rather than us giving to the charities of our choice. It isn't charity when you are forced and it isn't fair when we all know the government will waste that money and not do with that money what it was meant to be used for.

Also, I highly doubt that Jesus would find people receiving government assistance really suffering when they all have cell phones and multiple TVs and game systems in their houses.

It also amazes me that so many of you on here hate Christians and yet embrace Muslims....who oppress their women, stone homosexuals, etc. I just don't get it.

Funny - republicans donate more money for tax deductions and because they have it. - Nm

[ In Reply To ..]I don’t know a single democrat - who makes a distinction between

[ In Reply To ..]rich pubs and rich dems when talking about allowing across-the-board tax cuts for the wealthy to expire and expecting ALL Americans to shoulder their fair share. I AM, however, aware of a group of uber-wealthy democrats (Patriotic Millionaires, see link) who are actively organizing behind "doing the right thing" and allowing the economically devastating Bush tax cut policy to expire. The Op-Ed News piece (see second link) talks about how Orin Hatch and other GOP obstructionist Congressional members have responded to their idea by refusing to acknowledge their effort or so much as entertain the notion for even a nanosecond. It gives a pretty good history about how much higher taxes have been in the past on the upper crust, the corresponding positive effects on the economy that were historically evident and how Armageddon Did. Not. Happen. Let’s cut to the chase. Your first assumption is patently false.

Yawn. Charity is not the issue; tax cuts and revenues are. Tell you what. I would be more than happy to have this conversation with you on spending when you are ready to give equal time and consideration to revenues which by the way are also determined (or withheld, as the case may be) “as the government sees fit." You seem to have no problem with that side of the equation. In other words, place a tad more emphasis on the “what we are bringing in” component of your own statement when rethinking this issue.

People are “dependent” on roofs over their heads, food in their bellies and access to medical care for their survival. Furthermore, economies and the human beings that drive them do not prosper without jobs, education, training, investment in new markets and the like. When private sector Big Business, Wall Street and the wealthiest members of a society who ARE driven by greed horde resources that affect every single other sector just mentioned and corrupt politicians generate policies that protect them and fail to represent the interests of ALL of society, GREECE happens. Evidently you are not familiar with the austerity measures they have already been subjected to, which have absolutely nothing to do with dependence on the government. Riots happen when folks have been pushed beyond their limits.

Political corruption keeps tax loopholes open. We agree on this general concept, but not on which side fights to keep them and which one strives to eradicate them. Go back and read the Bible passages on money and wealth and then get back to me on the ones that make a distinction between charities of choice versus government systems that promote sound economic principles that allow equal access under the law to the things ALL members of society need to survive. They are not mutually exclusive concepts and are human activities that should be pursued in tandem.

Your parting shot about Christians and Muslims is simply too ignorant to merit further comment and adds nothing to the dialog except to showcase said ignorance.

http://patrioticmillionaires.org/

http://www.opednews.com/articles/Rich-Sign-Petition-to-Pay-by-kenneth-sibbett-110428-342.html

And nether does any republican - sm

[ In Reply To ..]What the republicans in office have been saying all along is everyone gets the same thing. They are not saying only rich republicans get tax cuts and not rich democrats. They are the only party who is making sense right now about not penalizing people for trying to better themselves. Something the democrats once again show they don't care about the people of the country. They've shown it these last few years.

What? - Time for a reality check.

[ In Reply To ..]Tax is not a penalty for anything. It is the main source of revenue for government expenses. The Bush tax cuts were never intended to be permanent. Thus, allowing them to expire is not even the same thing as a tax hike. It is simply restoring the rate back to 2000 levels, which are still the LOWEST LEVEL SINCE 1932 with the exception of the 5-year span between 1985 and 1992.

To suggest that expecting the rich to bite the bullet with the rest of us somehow shows democrats do not care about the people of our country is absurd. Quite the opposite. There NO justification whatsoever why the wealthy should not be expected to make sacrifices along with the rest of us. Balancing the budgets on the backs of middle class and senior citizens (who far outnumer the wealthy) is what shows a flagrant disregard for the vast majority of American citizens. Get a clue.

What? - Here's a reality check back

[ In Reply To ..]1. You're quoting a blog? Really? And from something called Docudharma? What??? Who the heck are they. There is no website anywhere that tells who they are, so all those pretty little charts are just bogus material. Also, they do not make sense. There is no information backing whoever created the charts. So nobody knows where the information came from. Hence, unreliable.

2. Your so called tax cuts you think were under Bush. Hey guess what...Obama is giving the rich tax cuts. He's extending what Bush did. Hence the term "Bush third term". I did not want another Bush term but guess that's what we all got stuck with. So please spare me with the blaming Bush about tax cuts for the rich. You need to blame the current crowd that is still giving them tax cuts. Why do you think corporations are backing him and donating so much money. To keep those tax cuts going.

And third, the republicans are the only ones who are trying to be fair regards to tax cuts. Tax cuts for all. That means you and I both get a tax cut. Not either or. We need some fairness here (and common sense). Something that's been lacking when the democrats are in control.

Posting a blog from an unknown source...I'd say nice try, but it's not even close.

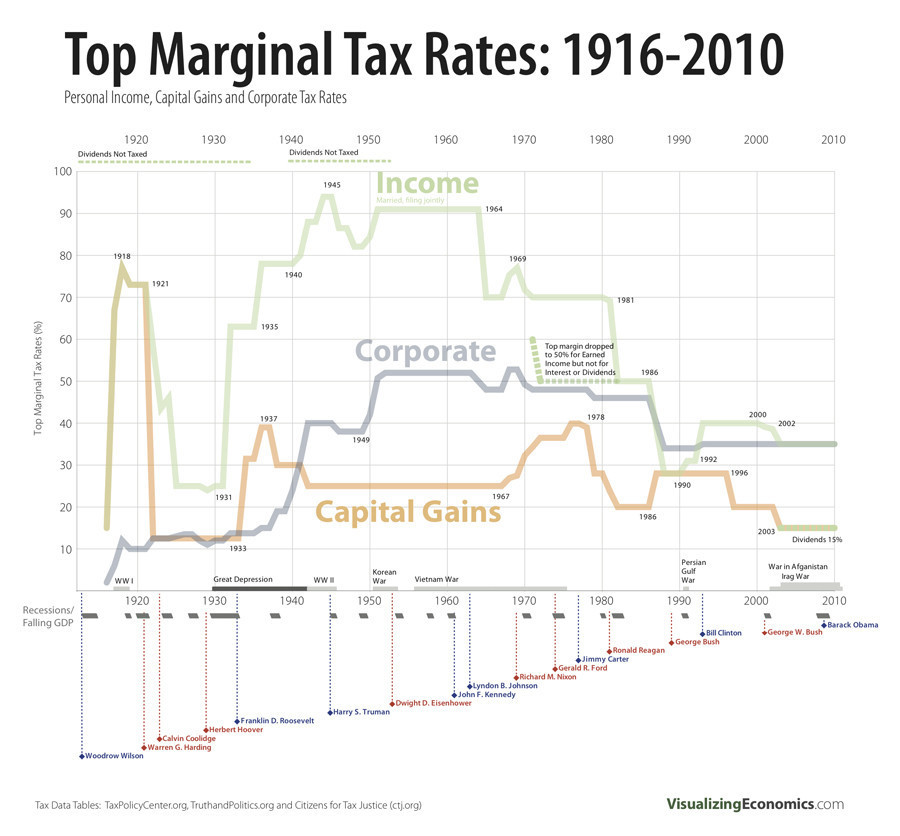

Your attention is drawn to the top of he graph just bellow the title - where you can clearly see

[ In Reply To ..]the source of the graph (National Taxpayers Union) and a link to its website. Those of us who are genuinely interested in reality know how to research the mountains of similar data available for these historical tax bracket rates. We also realize that historical data such as this which has been so meticulously preserved over the years by literally thousands of organizations cannot be disputed regardless of where they happen to turn up on the internet because fact is fact is fact.

You would not be one of those folks, so let me be of assistance to you. This is one of my favorites because it shows top marginal tax rates on income, corporations and capital gains along with the presidents and the corresponding years during which the rates were effective. It also shows 4 different surces at the bottom.

You indicated in your post that you have difficulty reading graphs, so if you find this one too intimidating, then follow this link to a really straightforward little table with simple columns and numbers from the Tax Policy Center and you will see that my claims about restoring top bracket tax rates back to 2000 levels reflect the lowest rates since 1932 with the exception of that brief 1988-1992 span are entirely accurate.

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=213

#2. I have already addressed the falsehood behind your second point at geat length in the post below entitled "The ONLY reason why Ws tax cuts were extended..." Pay special attention to the part that says "Do not delude yourself" at the end. According to the recent poll cited in the "Who do Americans Blame for the Economy" post, the view you have expressed here is decidedly in the minority.

#3. The GOP is only trying to serve their sugar daddies/election overlords with their tiresome tax cut schemes that had already decimated the economy by the time Obama was sworn while it sticking to the bottom 90% (AKA, majority of Americans). One only has to go as far as the TV remote to watch this being played out in living color. Check out C-SPAN House and Senate. Once again, most of us take heart in polls such as the one referenced above. It is really reassuring to know that Americans are not nearly as gullible as the tpots and cons "misunderestimate" them to be.

And your attention is drawn - see message

[ In Reply To ..]To the insult that said "You would not be one of those folks, so let me be of assistance to you." and figured if your going to be nasty there is no good reason to keep reading as I'm sure there are more insults in the post. Ooh yes, I forgot to say that graft you keep feeling a need to cut and paste was created by a lady and her "geographer" brother. If you like them fine. I will stick to legitimate sources to get my data.

Have a nice night.

You are just full of excuses - to justify why

[ In Reply To ..]you are unwilling to examine data that is available from literally thousands of organizations and sites, none of whom have anything to do with your fictitious lady and her (gasp) geographer brother (LOL). BTW, geographers are petty darned good with graphs and are very well educated folks. Any one of them that actually makes a living as a geographer more than likely has achieved at least a master's level education, since at the bachelor's level, they make only slightly more than a window cashier at Jack-In-The-Box. I oughta know. I took my undergraduate degree in geography back in the dark ages, just after the dawn of time. That is how I ended up transcribing medical reports. But hey, I digress.

Anyway, there is no getting around these well documented and universally accepted statitical truths. The 2000 tax rate which would be restored if Ws tax cuts for the wealthy were to expire would still be the lowest since 1932. Sorry, dear. It's just one of those hard core facts of life you have to learn to cope with. Statistical data of this nature is rock solid and indisputable. I know it's not fair, but there it is.

Your posts have made it abundantly clear that you are not interested in facts that have not been doctored and revised to back up the awesome bogosity of your baseless claims. It reminds me of how Bachmann and Palin fans feel compelled to hack into Wiki and revise American history that has been taught in schools for a century or two to cover their candidates (or candidate wannabes) behinds whenever they have made utter fools of themselves on national TV.

Please repost this wonderful graph at the top! - Encore!

[ In Reply To ..]It should not be buried under the . . .

And the problem with this statement is - its oversight of the context

[ In Reply To ..]of Colbert's statement. The segment was from Dec 16 last year, when the GOP were holding unemployment benefits hostage, err, I mean leveraging UI extension with extension of Ws tax cuts for the rich. For those of us who were unemployed, we remember it like it was yesterday, since they were doing this at Christmastime. Your response sounds just like Bill-Os statement (which among other things, claimed Jesus would not want us to be "self-destructive") with which Colbert was taking issue at the time while illustrating how "Jesus was a liberal" by paraphrasing a few Bible passages:

Matthew 5:40, "And if any man will sue thee at the law, and take away thy coat, let him have [thy] cloak also."

Matthew 19:21-24, "If you want to be perfect, go, sell your possessions and give to the poor, and you will have treasure in heaven. Then come, follow me." When the young man heard this, he went away sad, because he had great wealth. Then Jesus said to his disciples, "I tell you the truth, it is hard for a rich man to enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God."

Colbert pointed out that Jesus was beyond self-destructive and was, in fact, self-sacrificial. He corrected Bill-Os Jesus misquote ("The Lord helps those who help themselves") and correctly attributed it to Ben Franklin. The rest of his skit is funny and further illustrative of his contention that Jesus was a liberal.

Here are a few more what-would-Jesus-do Biblical statements on money and wealth you seem to be overlooking:

Matthew 6:19: Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal; but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also.

Luke 14:33: Any of you who does not give up everything he has cannot be my disciple.

Matthew 6:24: No one can serve two masters; for either he will hate the one and love the other, or else he will be loyal to the one and despise the other. You cannot serve God and Money.

Matthew 19:21-24: Jesus answered, "If you want to be perfect, go, sell your possessions and give to the poor, and you will have treasure in heaven. Then come, follow me." When the young man heard this, he went away sad, because he had great wealth. Then Jesus said to his disciples, "I tell you the truth, it is hard for a rich man to enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God."

Matthew 19:28-29: Jesus said to them, "I tell you the truth, at the renewal of all things, when the Son of Man sits on his glorious throne, you who have followed me will also sit on twelve thrones, judging the twelve tribes of Israel. And everyone who has left houses or brothers or sisters or father or mother or children or fields for my sake will receive a hundred times as much and will inherit eternal life.

Luke 9:23-25: Then he said to them all: "If anyone would come after me, he must deny himself and take up his cross daily and follow me. For whoever wants to save his life will lose it, but whoever loses his life for me will save it. What good is it for a man to gain the whole world, and yet lose or forfeit his very self?

Matt 13: 22: The one who received the seed that fell among the thorns is the man who hears the word, but the worries of this life and the deceitfulness of wealth choke it, making it unfruitful.

Hebrews 13:5: Keep your lives free from the love of money and be content with what you have, because God has said, "Never will I leave you; never will I forsake you."

Phil 2:3: Do nothing out of selfish ambition or vain conceit, but in humility consider others better than yourselves.

Acts 2:44-45: All the believers were together and had everything in common. Selling their possessions and goods, they gave to anyone as he had need

Half-witted? Really?

Colbert segment video:

http://samluce.com/2010/12/bonus-youtube-friday-jesus-is-a-liberal-democrat/

http://godisimaginary.com/i19.htm

Love Colbert. He's just too honest, it makes us uncomfortable. - Ouch! NM

[ In Reply To ..]NM

Incorrect statements - sm

[ In Reply To ..]The GOP was never holding unemployment benefits "hostage". Eeeks....sounds like a Mathews or Olberman statement regurgitated.

Second your so called "Ws tax cuts for the rich"....you do realize that those same rich people are getting tax cuts under your precious O.

Her statements are not incorrect - no1joe

[ In Reply To ..]And if I recall correctly, they tried the same stunt with the 9-11 bill. Don't know what Matthews or Olberman has to say about that though... just in case you want to suggest that I'm repeating what's been said on cable news. That's not my thing.

The ONLY reason Ws tax cuts were temporarily extended - is

[ In Reply To ..]because the GOP held unemployment benefits hostage and used them as a tool for emotional blackmail. It was quite a spectacle to behold. The histrionic fits, school yard bully tactics and recalcitrant obstructionism the GOP staged for their Christmas play made it quite clear that they were prepared to allow unemployment benefits to expire if Ws tax cuts were not extended. Guess they completely forgot about all those high-and-mighty spending cut demands they had made earlier that year around the 4th of July when they pulled the same stunt.

Obama did not have the heart to stand idly by and watch 14 million Americans and their families be thrust into financial turmoil and remain suspended in that nightmare while Congress went off for nearly 5 weeks on taxpayer dime for their winter break (not to mention the costly bureaucratic nightmare it would have created for federal and state unemployment office employees had the benefits expired, then be reinstated). Evidently, he placed their peace of mind over his own political welfare (since he said he would phase the tax cuts out during his campaign). He had no choice but to cave to the demands of a party who would not give their fellow citizens a second thought while millions of unemployed parents and their families suffered fear and despair throughout the holidays unless the rich could have their precious tax breaks.

I was one of those parents, so I feel perfectly justified in asking HOW DARE YOU imply Matthews and Olbermann are my puppetmasters? I sat there biting my nails day after day watching this debaucle unfold because it was shelter and food for myself and my family that was on the line. I certainly did not need any cable news hack or political pundit telling me what I am supposed to say or feel about this issue. Just for the record, I do not blame Obama one bit for going back on his tax cut campaign promise. It is clear as day to me who is responsible for the extension of this disastrous failed economic policy. I will always be grateful to him for having the courage to do the right thing, even at his own political peril. I can say with utmost confidence that I and 14 million of my closest friends intend to return the favor come election time. The GOP has ZERO credibility on jobs or the economy with this group of voters, who will be showing up in droves to cast their ballots. You can take that to the bank.

Do not delude yourself into thinking Obama's extension of Bush tax cuts is in any way an endorsement of that policy. I would not be the least bit surprise if he finds a way to cancel them before the 3-year extension is over.

Similar Messages:

Anyone Interested In A Laugh - Stephen Colbert Does It Again!Nov 11, 2009

http://rawstory.com/2009/11/gop-rep-cockblock-delaware/ ...

Stephen Colbert Had To Correct His Audience When TheyMay 10, 2017

they hadn't been told what to think yet. The sheeple had not yet been apprised of the latest DNC talking points. I'm "glad" Colbert straightened them out. ...

Stephen Colbert On The Catholic Pedophile Cover-upMar 31, 2010

http://www.colbertnation.com/the-colbert-report-videos/268495/march-30-2010/the-word---forgive-and-forget ...

Stephen Colbert Was Brilliant In His Testimony Before CongressSep 27, 2010

http://www.youtube.com/watch?v=t39uqg6e4so&feature=player_embedded ...

Stephen Colbert Talking To Hillary CartoonJul 27, 2016

Did anybody happen to catch this on Stephen Colbert last night? Too funny! ...

"Wildly Important" Stephen Colbert Funny!Jun 25, 2010

http://www.huffingtonpost.com/2010/06/24/colbert-rips-glenn-beck-f_n_623906.html ...

Stephen Colbert - "The Word"Apr 27, 2010

http://www.colbertnation.com/the-colbert-report-videos/308060/april-26-2010/the-word---docu-drama ...

Words Of Wisdom FromOct 15, 2012

Patriotism means to stand by the country. It does not mean to stand by the president. -- Theodore Roosevelt. ...

Colbert Countering Beck?Sep 03, 2010

I have to admit I think this would be funny. lol Internet Petitions Stephen Colbert To Hold 'Restoring Truthiness' Rally At Lincoln Memorial Huffington Post | Katla McGlynn A grassroots campaign has begun to get Stephen Colbert to hold a rally on the steps of the Lincoln Memorial to counter Glenn Beck's recent "Restoring Honor" event. The would-be rally has been dubbed "Restoring Truthiness" and was inspired by a recent post on Reddit, where a young woman wondered if the ...

Colbert To The Rescue - SC SchoolsMay 07, 2015

Comedian Stephen Colbert announced Thursday that he would fund every existing grant request South Carolina public school teachers have made on the education crowdfunding website DonorsChoose.org. Colbert made the announcement on a live video feed Thursday at a surprise event at Alexander Elementary School in Greenville. Colbert partnered with Share Fair Nation and ScanSource to fund nearly 1,000 projects for more than 800 teachers at over 375 schools, totaling $800,000. ...

Bernie Sanders On ColbertSep 20, 2015

https://www.youtube.com/watch?v=s8Czq0Eb2Uw&feature=youtu.be ...

I Need Some Pearls Of Motherly Wisdom Here.Mar 28, 2017

My 24yo son lives with his girlfriend and has two kids with her. I just got a text from son today basically telling me that he doesn't like the way I treat his girlfriend. That I make passive aggressive remarks and I need to stop. I need to realize that he is an adult and I need to let him go and stay out of their business. I'm not going to lie. I don't particularly like the girlfriend. For starters, she's still married to another man and h ...

Words Of Wisdom, By Michele BauchmannOct 04, 2012

Swine flu: "I find it interesting that it was back in the 1970s that the swine flu broke out under another Democrat president, Jimmy Carter. I'm not blaming this on the President Obama, I think think it's an interesting coincidence." --Comparing the 2009 swine flu outbreak to the 1976 outbreak that occured under...Gerald Ford. 2009 On the national debt: "I think if we give Glenn Beck the numbers, he can solve this." -2011 Michael Steele: "Michael Steele--you d ...

I Love Me Some Jeb. Words Of Wisdom. Looks Like He's Revving' Up His Feb 24, 2014

Reality check offered up by J. Bush to the GOP: "I think we've become a little more harsh than we need to be, so the first step would be to tone it down a bit, chill out," Bush said, adding: "We shouldn't be sending signals that turn them off from the get-go." The video is better than the quote. Captures the essence of his appeal. The whole interview is pretty awesome. How is the TP going to handle this? ...

Colbert: Scalia Correct That A Cross Has Nothing To Do With Christianity.Oct 15, 2009

Not Friday yet, but Colbert does it again! http://rawstory.com/2009/10/scalia-says-cross-no-longer-represents-christians/ ...

Colbert On Rush As Victim Clip From ShowMar 18, 2012

http://videocafe.crooksandliars.com/heather/colbert-takes-limbaugh-being-attacked-demo ...

A Few Words Of Wisdom About The Election From Barbara BushNov 17, 2012

http://www.huffingtonpost.com/2012/11/16/former-first-lady-barbara_n_2141769.html?utm_hp_ref=mostpopular ...

Has Anyone Else Read Stephen King's New Book "Under The Dome?"Jan 19, 2010

I got this book for Christmas and haven't been able to put it down since! It's 1,088 pages long, but what a page-turner! Not horror - it's more a comment on society. I'm down to the last 200 pages and it's almost impossible to force myself to put it down and a. work, b. cook, c. sleep, d. keep house, etc, etc, etc. I highly recommend it! ...

Colbert On "Survival Seed Bank"Mar 11, 2010

This is hilarious!! http://www.colbertnation.com/the-colbert-report-videos/267141/march-10-2010/survival-seed-bank ...